Disclaimer – I am not a financial advisor. I am not recommending any products or services. Your financial situation is unique so please do your own research and become familiar with your own options. The following is simply my advice to my daughter and her particular situation.

My oldest daughter recently graduated nursing school and began her career at a large hospital. As she went through orientation, they presented her with the benefits package options, so she brought them over and we sat down and read through the information.

In addition to an interesting conversation about which benefits to select, it also began a new conversation about financial decision-making in general. Here’s my advice to her; I hope it can help you as well.

I began to learn about employee benefits while doing a side hustle for a pension administration company in my twenties. I created a customer database for them that brought me closer to 401(k) plans, pension plans, and the world of benefits. This ultimately lead to me cofounding a software business, Benefitfocus, for employers and insurance carriers to manage all of their benefits online and in one place.

I have seen thousands of benefit programs and spoken to many employees about their choices (there are now over 20 million people using our software to enroll in their benefits).

As my daughter and I looked over her benefits options, I kept coming back to general concepts that have helped me make similar decisions, both for myself and from watching the outcomes of many decisions made by others.

Here are the Five Keys to designing your own benefits portfolio I gave to my daughter as a recent college grad:

1. Financial Literacy Is Your Best Investment

My general rule is that an hour spent learning a subject will pay you back a hundred fold over your lifetime in that area. There is no better domain to apply this rule than that of your personal finances. Read some blogs, watch some videos, read a few chapters in a book.

I read one time that people who were successful in reaching their financial goals spent on average eight hours a month reading and studying personal finance. So a few hours a week or one day a month is needed to reach our financial goals. Use that as a guide to maintain a steady diet of learning in this area, and make sure to include learning about your benefits in this ongoing area of study.

Perhaps the biggest hurdle to overcome with financial literacy is the false belief that you can’t learn this stuff. We have all sorts of narratives in our heads that are untrue. For many people, a big one is that we’re just not good at money or financial matters. False! We all can learn the basics, and when we apply some simple math to the basics of our finances, we’ll gain significant rewards over time.

Benefits can be boring and intimidating but they make up about 30% of your compensation. Over the course of your career, if you highly leverage these good benefits you will be way, way ahead of just about everyone else in the workforce. Use them for your good. And to do that, I’ve included some references and links below to help you get started!

2. Pay Yourself First

You are going to work for several companies and many managers and teams over the course of your career. Work hard and help those teams be successful. Even though you are serving others, it is totally fine to pay yourself first.

There is a long line of people and entities waiting to get some of your hard-earned cash. The IRS, the mortgage company, utility companies, Amazon, Starbucks, and so many more.

Put yourself at the front of that line, and keep yourself there. The best way to do that is to automate it out of your paycheck. 401(k), HSA, any sort of retirement program your company offers. It is important to note that this is not being selfish—quite the opposite. When you have a solid financial position, you’ll be in a stronger position to support your community. I’ll write more on my thoughts on giving and generosity in future posts, but I wanted to mention here that paying yourself first is not in conflict with giving. They work together.

Aim to save 25% of your paycheck. It’s easiest when you first graduate because any new income is more than you are used to living on. Plus, you can share costs such as rent and utilities with a roommate or two. This is the perfect time to create a personal philosophy and simple framework for saving.

Now, to most people saving 25% of your pay seems ludicrous, even impossible. I say great! You want to be in rare and obscure areas where you are doing rare things. This generally leads to huge advancement. In this instance, paying yourself first, be bold. Don’t settle for the standard 5–10% savings rate. You will have to work forever doing that.

People often see “saving” as some sort of hardship. They also see “spending” as some sort of perk or reward. In reality, when you receive money you will be spending it on something. You can either spend it on freedom in the future, aka saving, or you can spend it on something to experience today. It is more about timeframe. Most people are doing 100% or even more on today expenditures. Very unique and radical people are spending 50%, 75%, even 90% on their future selves via saving. You want to orient yourself toward the unique and radical end of the spectrum in this area of life. It will lead to outsized rewards and much more personal freedom in your future.

They key is to understand this principle and make it work for you. Be intentional. You are going to live a long life. Use your money over that expansive period. Allocate 25% or more of it for your long-term health and freedom.

(Here’s a super-useful article and table to help you figure out how much to save and when you will be able to retire: The Shockingly Simple Math Behind Early Retirementby Mr. Money Mustache.)

My daughter’s company offered a retirement savings plan that matched dollar for dollar up to 5% of her pay and allowed her to contribute up to 14% of her pay, for a total of 19%. She signed up for the max amount. See #4 below for how she invested it.

3. Buy as Little Insurance as Needed

There is a saying in the insurance industry that goes like this: “Insurance is sold, not bought.”

I have always thought that statement, and the philosophy behind it, is so unfortunate. What it means is that nobody wants to buy insurance. It has to be pushed on them. Arm twisted and often high pressured. People run away from that. Or they begrudgingly “get sold” some product they don’t want and don’t understand.

You can be different!

Develop a simple philosophy that aims at covering yourself for the possible bad things that can happen. However, don’t buy things that you do not understand or you’re not clear on how they’ll benefit you.

This takes us back to key point number one, it takes some time to read and study these personal finance topics. But in a few hours time you can get a grasp on these important areas, and as you create a routine of study, you’ll turn this into a strategic advantage in your quest to build an awesome life.

Here’s a very simple breakdown of the most common employer-provided insurance types:

- Health Insurance– Don’t fear the “High Deductible Health Insurance Plan” (HDHP). If you don’t have a chronic condition and aren’t facing a major medical procedure in the next year, then buy as little insurance as you can. This generally correlates to an HDHP. This then means you have a knowable size of risk that you’ll have to cover if something unexpected comes up. This is an acceptable risk and one you can save for by pairing it with a Health Savings Account (HSA).

- Health Savings Account– The first year you sign up for a Health Savings Account will feel a little scary. That account, with just a few dollars in it, will not bring much comfort. But you can max it out, and in a few years it will turn into a super power and embolden you to continue point A above, buying as little health insurance as you need and saving the rest. In a few years, your HSA account will grow and you can essentially begin to self-insure most of your health risk. Note: If this “bet” does not work out for you while in the early few years of savings, it won’t be the end of the world. You can recover. You still have insurance for the catastrophic scenarios.

- Life Insurance– Many employers offer a sort of basic salary-coverage life insurance for free. Meaning they will give you a policy that will pay one or two times your annual salary if you pass away. For a recent college grad with no mortgage and no family, this is plenty of insurance. Gladly accept it and skip the rest of the stuff they try to sell you. If you do have a family or other debts, then research the additional coverages and compare them to buying a term-life policy directly. Only when you understand the costs and benefits can you make an informed decision.

- Other– There may be a host of other optional or coverages available to you, such as voluntary short- and long-term disability insurance. Sometimes these are at deep discounts compared to buying them on your own. But first you have to establish that you really need them and only then compare them to buying direct.

I helped a friend of mine start a benefits blog recently. Here is a helpful article of his on selecting health plans.

4. Understand and Avoid Fees and Commissions, Use Index Funds

Now that I am saving, where should I invest the funds in my employer’s retirement plan?

Great question, but first let’s discuss fees.

The one known variable in investing is fees. Gains generated by dividends and appreciation are not certain, but fees are. So understand them completely. Minimize them and only pay for value.

In my daughter’s benefits package she had many options. There were lifestyle portfolios, target date portfolios, managed funds, and simple index funds. We spent time reviewing these and discussing them. Some of the investment fees were over 1.5%, which is outrageous.

Thankfully, her company had a selection of low-cost index funds from Vanguard as well as a few modest-fee mutual funds. Since she’s in the healthcare industry, she selected a portion of her savings to go into a quality healthcare mutual fund. The rest went into all stock index funds with very low expenses.

From the options her employer offered, this is the simple portfolio she designed:

- 70% Vanguard S&P 500 Index Fund: This buys her shares in 500 of the largest U.S.-based companies at an astonishing low fee of just .04%.

- 15% Vanguard International Equity Index Fund: This buys her a wide array of global companies. It also has a low expense ratio of just .10%.

- 15% Healthcare Mutual Fund: Since her chosen career is in healthcare, this will allow her to participate in the value created in her own industry.

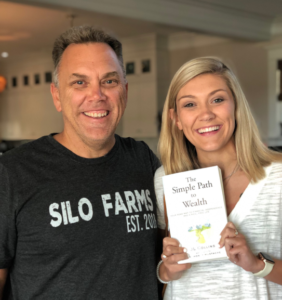

I met and became friends with JL Collins last year at his Chautauqua event, and when my daughter graduated, he was kind enough to sign a copy of his book, The Simple Path to Wealth, which I know will bring her lasting value. JL’s blog has a legendary “Stock Series” that is both fun to read and very educational.

Another good book is The Little Book of Common Sense Investing by the founder of Vanguard, Jack Bogle.

5. Financial Independence Is a Good Goal

When you’re starting your career there’s a lot of optimism. There’s also a good bit of unknown. As we enter the workforce, we begin to meet people who are naturally happy at work, and those who are unhappy.

Rather than waiting for other people to shape your views on your career, it’s good to have a simple plan to make your career serve your long-term financial goals. It can save a lot of back and forth soul searching later on.

Fortunately, for the generation entering the workforce today there is a strong movement toward Financial Independence (FI). The FI Community, as it is often referred to, generously shares advice on how to optimize one’s finances and accumulate one’s savings so that you are not dependant on any one job or company. I believe this movement will have a profound effect on how employers view their relationships with their employees and in turn affect the types of benefits they offer.

I mentioned this relatively new concept to my daughter during her benefits selection process because I wanted her to not just learn a few terms and job strategies, but rather think bigger and bolder about what her financial life can be. I also wanted her to know how big an impact she can have on her own finances by cultivating her own personal and unique vision of her future.

FI isn’t a single milestone somewhere out there in the future. Rather, it’s a journey. And like all journeys, it starts with only a few steps. One of those steps is optimizing your employer provided benefits for your good.

Final Thoughts

These employer-offered benefits are intended to help us, to be for our good. Unfortunately, they are drab, boring, and often intimidating. You can radically change that and make these benefits work for you by seeing them as a part of achieving the lifestyle you desire.

If you save little to no money along your journey, then you’ll be doomed to 45 to 50 years of working a job you might not enjoy. If, however, you spend just a little time studying and you save 25% of your income, you will magically shave off 20 or more years of your work life and create all sorts of options for yourself in the future. You may even go all-in on FI and save 50% or more and end up retiring in your thirties or forties. The key is that you want that to be up to you, not your employer or the economy.

Ask a lot of questions. Do research. Go pester your HR and Benefits department. Uncover what those fees and commissions are in every product you’re being sold. Take on the power and chart your own course. Not only will it be good for you, it will be great for your employer and your career, as you’ll do your best work when you’re doing it out of joy and confidence rather than begrudgingly or out of fear.

We all spend our hard-earned money on something, and time is your most valuable resource. So you might as well spend your money on freedom and time for your future self. She will thank you!

Additional Resources:

- Millennial Revolution– Kristy and Bryce have a fantastic blog, investment info, and a new book coming out!

- ChooseFI Podcast– Brad and Jonathan have created an amazing platform of real-life interviews and stories on how people are managing their money and gaining independence.

- Afford Anything blog – A foundational post by Paula Pant is The Ultimate Guide to Financial Awesomeness. (BTW she recommends saving a minimum of 20% and working up from there)

- Frugalwoods– A blog and a book about a young couple’s journey through high-stress careers to a more intentional way of life.

- Mr Money Mustache and JL Collins– The first two blogs I discovered on the FI community. I have read more posts on these two blogs than any place else, so far! (In JL’s book he recommends to his daughter to save 50% and get to FI early)

- The Year of Less– Great book by Cait Flanders on how she paid off $30,000 in debt and became financially independent.